Tax Abatement

What inducement did the South City Partners receive for their project at Sam’s Crossing?

The Downtown Development Authority of Avondale Estates (DDA) entered into a “Bond for Title” inducement with the developer. In this arrangement, a portion of the project is owned by the DDA for a period of time, which lowers the property taxes due on the project. This inducement is widely used by development authorities in Georgia to encourage large projects to be built in a given area.

Why was this important to the project?

In the final weeks before closing the deal, the developer received notice from DeKalb County that sufficient sewer capacity may not be available for the project. The solution to this was an unanticipated new structure on the premises to add storage capacity while the county improves its sewer system.

Would the project have been built if the DDA had not done the inducement?

This late-breaking news put the project in peril, but it is hard to say whether the developer would have found another way or not. One of the other ways to resolve this would have been to approach the County’s development authority with the exact same request. If that had happened, the taxes that were abated would have been the same – the difference being that Avondale would have been seen as not willing to help a responsible development in its most difficult juncture.

How much revenue will the City get now, instead of if the project had not gone forward?

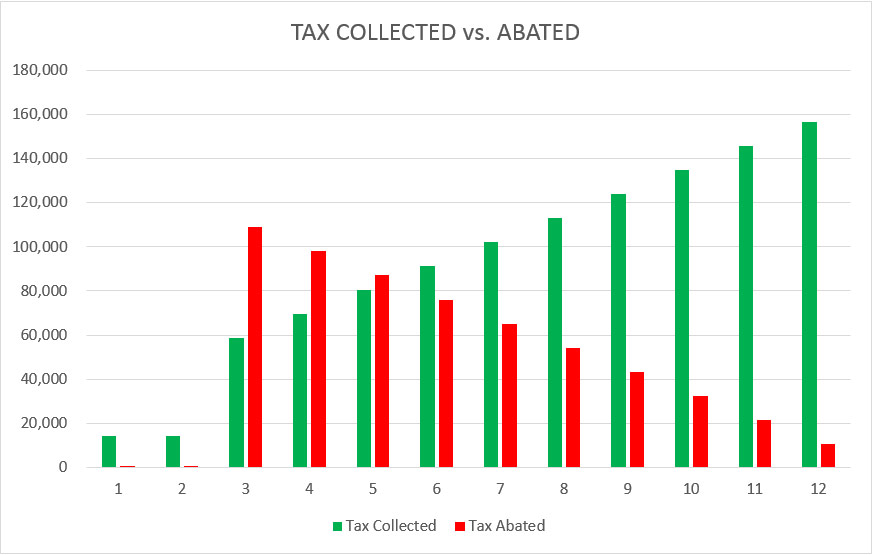

Obviously, that depends on whether any other company would have developed the land, or it had stayed in its traditional use, which paid $6,201 to the City per year in taxes. If a failed deal had cooled the demand for building on that site by 3 years, then the taxes expected to be collected during that time would have been $18,603 ($6,201 x 3).

Now that the project has gone forward?

The taxes collected in the first year of the abatement (2019) will be $58,547, a nine-fold increase over the previous year’s (no-development) payment. And each year, the portion of taxes paid increases by 6.5%, until in the 10th year, the abatement is over, the bond is paid and title to the property is fully with the developer, and DDA is out of the project.

Did the City have to back the bond with its “Full Faith & Credit”?

No, the entire bond is secured by the project, and does not impact the City’s debt picture in any way.

Will this action affect the TAD (Tax Allocation District)?

This portion of the downtown is not in the Tax Allocation District, so no increased taxes would have gone to the TAD.

Since DeKalb County and the School Board have to also agree to the TAD – did they have to agree to this deal, also? Or did one of both refuse to go along?

The Bond for Title inducement lowers the taxes due to all three entities, because the method of abating taxes is that the DDA owns a portion of the project. DDAs do not pay property taxes, so the inducement affects the taxes collected by all three entities.

Will the DDA be doing another inducement for coming development?

It is certainly one of several methods to be considered in incentivizing outstanding design and smart development in our downtown. Most (if not all) future developments the DDA will be working with will be in the TAD area, so the benefits to our community of any inducement have to be weighed in terms of how much value the developer is bringing to the community, measured against the benefits to the City of any method at the disposal of the DDA (or the City).

How is the Tax Abatement Incentive different from the Avondale Tax Allocation District (TAD)? Will the Tax Abatement impact the Avondale TAD?

The Avondale TAD covers a specifically defined geographic area or district (see map.) Taxes within TAD are paid as usual, but once a development is built, any future tax revenue above the base value is limited to infrastructure expenditures related to the district. Examples include utilities, stormwater and sanitary sewers, sidewalks, streetscapes and pedestrian improvements, parking facilities, green space and parks, wetlands mitigation, transportation and transit facilities.

Dekalb County School District (DCSD) does not currently participate in the Avondale TAD. http://avondaleestates.org/DocumentCenter/View/1321

However, both DCSD and DeKalb County taxes are typically included in Tax Abatement incentives. It is possible for a Tax Abatement incentive to be added as an additional layer to the TAD only after the appropriate due diligence and consideration of economic costs and benefits to the city.

Since tax abatement does not require County or School District approval, if the City does not do an abatement, can the County do one? And if so, does it affect the City as well?

Yes, the County can also choose to do an abatement. It, too, would affect City, County and School District taxes.